In general Accounting is considered as the language of business throughout the world. In a simple term the language is the means of communication of ideas or feelings by the use of conventionalized signs, gestures, marks and articulated vocal sound. It is effectively employed to communicate the financial performance of business to various interested parties or stakeholders.

1. Meaning of Accounting

In the same way, the accounting language serves as a means to communicate matters relating to various aspects of business operations. As the individual business enterprises keep their accounting records separately, the offer to communicate is essentially from a business enterprise to various individuals, groups and institutions that are having interest in the operations and results of that enterprise. Now, although accounting is generally recognized with the business, trade and profession, the business enterprise is not the only kind of organization that makes use of accounting. Legal entities ranging from individual to governments use and prepare accounting to obtain information on the financial condition and performance of the entity in question. Just as the business enterprises (like firms, companies, societies and institutions keep their accounts, so can the nations and even the individual owners of the business and profession entities.

It is necessary to have a good knowledge of accounting-grammar (in the shape of construction of accounts, conventions, concepts, postulates, principles, standards etc.) to interpret accounting information for purposes of communication, reporting, decision making or appraisal.

2. Need and Importance of Accounting

The objective doing every business whether large or small is to earn profit. In a business, the businessman receives money from certain sources like sale of goods, interest on bank deposits etc. He also spends money on certain items like purchase of goods, salary, rent, electricity, insurance etc. These activities help in carrying out the operation of the business. At the year end, the businessman would like to know the progress of his business. A large number of business transactions take place, because of which it is not possible to recall by the businessman with his memory as to how the money had been earned and spent. But, if the business man notes down his incomes and expenditures, he can readily get the required information. Thus, the details of the business transactions have to be recorded in a clear and systematic manner to get answers easily and accurately for the following questions at any time the businessman likes:

- What are the revenues and expenses?

- What is the result of the business transactions?

- Is business making any profit?

- Am I making or losing money from my business?

- How much amount is receivable from customers to whom goods have been sold on credit?

- How much amount is payable to suppliers on account of credit purchases?

- How much is owed to the business?

- How much do the business owe to others?

- Should I put more money in my business or sell it and go into another business?

- How can I change the way I operate to make more profit?

All the above and several other questions are answered with the help of accounting. The need for recording business transactions in a clear and systematic manner is the basis which gives rise to Accounting.

3. Definition of Accounting

According to American Institute of Certified Public Accountants (AICPA),‘Accounting is the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events which are, in part at least, of financial character and interpreting the results thereof’.

4. Difference between Accounting and Accountancy

Generally, the terms accounting and accountancy are used interchangeably but there is a thin line difference between these two items. The term accountancy is used for the profession of accountants – one who does the work of accounting whereas, accounting is the systematic process of recording all business transactions and translating all intangible reports for its intended use by the user.

5. Aspects

1. Record keeping: The system of record keeping of financial transactions requires the use of standard set of accounting policies, practices and procedures, as well. It is concerned with the recording of transactions in an orderly manner, soon after their occurrence in proper books of accounts.

2. Tracking of financial transactions: In business organization, various transactions are entered and collection and analyzing of each such transaction needs separate accounting procedures.

3. Financial Reporting: Several reporting frameworks, most notably Generally Accepted Accounting Principles (GAAP), International Financial Reporting Standards (IFRS), etc. mandates a specific manner in which the financial transactions of a business organization must be reported and aggregated in the financial statements. This results in the preparation of Statement of Profit and Loss, Balance Sheet, Statement of Cash Flows along with the supporting disclosures.

6. Types of Accounting

| Financial Accounting | The systematic process used to generate the financial results of a business organization. The result of all the financial transactions of an entity is summarized and recorded in terms of the Balance sheet, Statement of Profit and Loss, and Statement of Cash Flows. |

| Cost Accounting | For every business, it is of great importance to determine the cost relating to product manufactured and cost accounting helps the businesses to make costs decision. The results produced can be used to determine what a product should costs. |

| Forensic Accounting | This accounting is an important branch of accounting that collects, recovers, and restores the financial information as a part of the investigation process. In order to widen its scope, a proper framework defining a set of benchmarks for forensic accounting is in motion. |

7. Methods of Accounting

Generally, there are two main methods of recording financial transactions in the books of accounts:-

1. Cash system: Under this system of accounting, financial transactions are not recorded in the books until the related cash amount is actually received or paid. This system does not make a complete record of financial transactions as it does not record credit transactions and does not provide a true picture of profit and loss at a point in time.

2. Accrual system: Under this system of accounting, financial transactions are recorded in the books of accounts as and when it accrues during the period. This system gives a complete picture of financial transactions entered during the period as it makes record of all the transactions entered during the period irrespective of cash received or paid.

Taxmann’s Basic Accounting book provides a thorough analysis & new insights on basic accounting and interpretation in simple language.

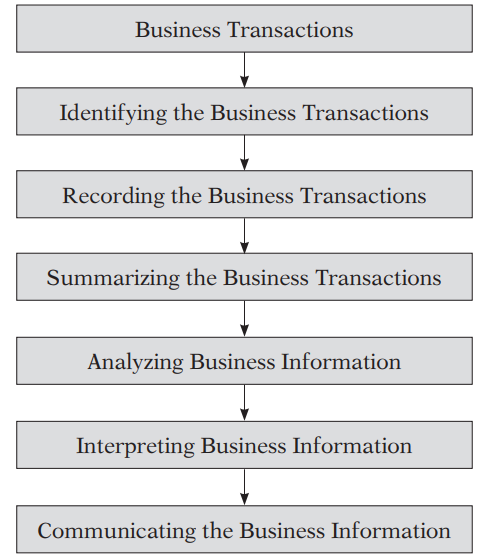

8. Process of Accounting

On the basis of the above definition the process of accounting is given:

In order to accomplish its main objective of communicating information to the users, accounting embraces the following functions:

(i) Identifying: Identifying the business transactions from the source documents.

(ii) Recording: The next function of accounting is to keep asystematic record of all business transactions. Recording is done in the order of their occurrence. First transactions are recorded in the book called journal. This journal is again further be divided into several subsidiary books according to the size and nature of business.

(iii) Classifying: Classification refers to the process of analysing and grouping the recorded data in one place on the basis of their nature to get the instant information. The book where the classification is done is called Ledger.

(iv) Summarising: Summarising refers to the preparation and presentation of classified data in a useful form to the users of accounting information. In this process the financial statement are prepared which are:

(a) Profit & Loss Account

(b) Balance Sheet

(c) Cash Flow Statement

(v) Analysing: The accounting information which are presented by financial statements may not be easily understandable to everyone. So this requires the simplification of the data from financial statements. Therefore analysing refers to the process of simplification of the data presented in financial statements to make the users easily understandable.

(vi) Interpreting: Interpreting in the process of explaining the meaning and significance of the simplified data established by the analysis. Interpretation helps the users to take correct decisions on the basis of the information available.

(vii) Communicating: The results obtained from the summarised, analysed and interpreted information are communicated to the interested group of users.

9. Accounting Concepts

1. Separate Business entity concept: While accounting for a business organization, we make a clear distinction in between the business and the owner. All the business transactions are recorded from viewpoint of the business rather than from the viewpoint of the owner. The proprietor is considered to be a creditor of the entity to the extent of capital bought by him.

2. Double Entry concept: Every financial transaction requires two aspects of accounting to be recorded for example if a firm sells goods worth Rs. 5,000 this transaction involves two aspects. One is reduction in stock worth Rs 5,000 and other receipts of Rs. 5,000 cash. The record of these two aspects of a single transaction is termed as a double-entry system. According to this rule, the total amount debited will always match total amount credited. The fundamental accounting equation to above rule is:-

Assets = Liabilities + Owners Equity

3. Going concern concept: Accounting assumes that business will continue to operate for a longer period of time in future. In other words, it is assumed that neither there is any intention nor necessity to curtail the business operations of entity. It is on this basis that financial statements of a business entity are prepared and referring to which investors agree upon their decision to invest in the business.

4. Matching concept: This concept states that the revenues and expenses must be recorded at the same time at which they are incurred. In general, we match the revenues with the expenses incurred during the accounting period. Broadly speaking, income earned during a period can be measured only when it is compared with the related expenses incurred. On the basis of this concept several adjustments are made for prepaid expenses, accrued incomes, etc. while preparing financial of a period.

10. Objectives of Accounting

The objectives of accounting are being discussed below:

- To maintain systematic records of Business: The main objective of accounting is to record the business Transactions of financial nature in a very systematic way by following some specified principles. These records should be done in such a way that the required information related to business could be provided at a glance.

- To Calculate Operational Results (i.e. Profit or loss): One of the important objective of the accounting is to find out the result of the operations performed by the business during particular period i.e. accounting year. Income statement (Trading and Profit & Loss Account) are prepared to know the result of the operations of the business i.e. Profit or Loss. The operational result also helps in evaluating the performance of the business.

- To show the financial position of business: Accounting helps in knowing the financial strength and weakness of a business on a particular date. The resources (Assets) and the obligation (Liability) are being shown through the preparation of position statement (Balance Sheet) which helps in evaluating the financial position of the business. The preparation of position statement is possible only through systematic recording of transactions.

- To make information available to various users: Accounting makes available the required information related to business to various users both internal as well as external to the business. Owners want to know the operational result i.e. profit or loss, Bank and creditors want to know the financial soundness, Employees are interested in knowing increased wages, Govt. authority is interested in levying tax etc. All users can have the required information through accounting.

11. Overview of Objectives of Accounting

| Accounting | Objectives | Modus Operandi |

| Journal, Ledger, Trial Balance | |

| Manufacturing, Trading, Profit & Loss Account | |

| Balance Sheet | |

| Financial Reports | |

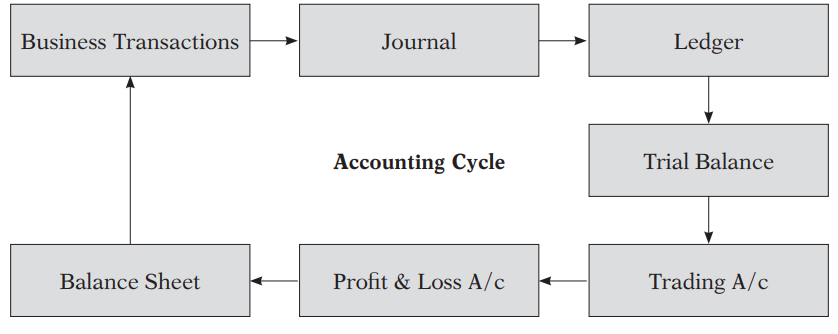

12. Meaning of Accounting Cycle

Accounting cycle is a complete sequence of accounting process, that begins with the recording of business transactions and ends with the preparation of final accounts.

13. Business Transactions

Every business enterprise involves in various economic activities. These economic activities are the exchange of goods and services which can be measured in terms of money. These exchange of goods and services which are measurable in monetary terms are considered as business transactions. Some of the examples of business transactions are given below:

- Purchase of Raw Materials.

- Sale of products to customers.

- Payment of Rent.

- Purchase of Machinery for business.

- Purchase of Furniture for the business.

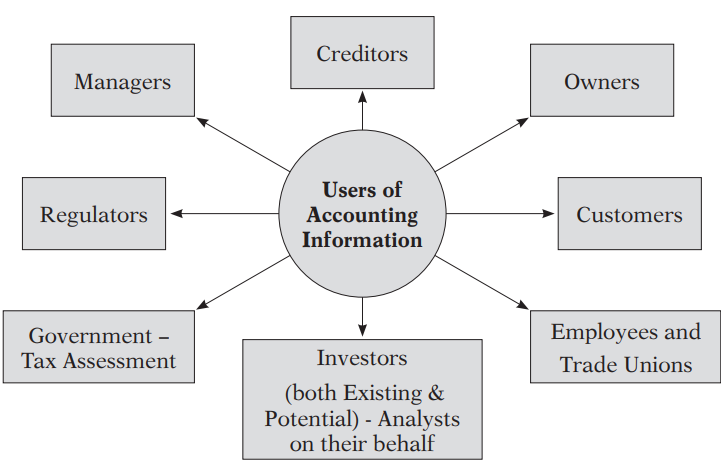

14. Users of Accounting Information

The information provided by Accounting are being used by both inside the organisation as well as outside the organisation. On the basis of the user there are two group of users of accounting information : internal users and external users.

Internal users are management, owners, employees, trade unions etc. External users are creditors, investors, banks and other lending institutions, present and potential investors, Government, tax authorities, regulatory agencies and researchers.

- Owners: The owners use the accounting information to know the operating result and financial position of the business.

- Creditors and Lenders: Creditors and lenders use the information to determine the repayment capacity when becomes due. In other words they use it for judging the creditworthiness of the business.

- Managers: The Managers use the information to operate and manage the business in an efficient manner.

- Customers: The customer uses the information to know the stability and profitability of the business. As the functioning of the business also have impact on the supply of goods in the market.

- Government: To know the earnings in order to assess authorities the tax liabilities of the business.

- Regulators: To evaluate the business operation under the regulatory legislation.

- Investors: The existing investor who has already investment in the business use the information to know the position, progress and prosperity of the business in order to ensure the safety of their investment. Whereas the prospective investors use it to make decision about whether to invest in the business or not.

- Employees and Trade Unions: The employees and trade unions use the information to check the earning capacity of the business to relate it to their remuneration and bonus.

15. Branches of Accounting

The Accounting has three main branches which are

(a) Financial Accounting,

(b) Cost Accounting, and

(c) Management Accounting.

15.1 Financial Accounting

Financial accounting is concerned with recording of transactions in the books of account of a business in such a way that the financial statements could be prepared at the end a period. The preparation of financial statements helps in knowing the operating result and the financial position of the business. The financial accounting also provides financial information which are required by the management of the organisation as well as other external users associated with the business.

15.2 Cost Accounting

Cost accounting is concerned with the collection, classification and ascertainment of the cost of production or job undertaken by a business. The main objective of this accounting is to ascertain the cost of various products produced by the business enterprise and help in fixing the price of the products. The cost accounting also helps in controlling the costs of the organisation.

15.3 Management Accounting

Management Accounting is related to the use of accounting data collected with the help of financial accounting and cost accounting for the purpose of management of the business organisation efficiently. It helps the management in the process of policy formulation, planning, control and decision making by the management.

16. Functions of Accounting

- Systematic Records: The most important function of accounting is to record systematically the business transaction of financial nature in a business enterprise. The transactions are recorded on daily basis in Journal, classified through posting them into Ledger and summarized through preparing financial statements – income statement and the balance sheet.

- Communicating the information to the interested parties: Another important function of accounting is to communicate financial information in respect of operating results (Profit or Loss) and financial position (Assets and Liabilities) to the interested parties as per the requirements.

- Meeting Legal Requirements: The business enterprises have to comply with various provisions of various laws like the Companies Act, Income-tax Act, etc. These compliance require the submission of various statements like income tax returns, annual financial statements etc. Accounting helps through systematic recording and reporting in meeting these compliances.

- Helps in Managerial Decision Making: To make a correct decision it is required the updated and correct information. Accounting provides the required information to the management on time through systematic recording which helps in taking important decisions regarding business.

- Forecasting: Accounting helps in providing past data which are helpful in forecasting future performance and financial position of the business enterprise.

17. Terminology

- Assets: The valuable things owned by the business are known as assets. These are the properties owned by the business. Assets are the economic resources of an enterprise which can be expressed in monetary value. Assets are classified into Fixed Assets and Currents Assets.

- Non-Current or Fixed Assets: Fixed assets are acquired for long term use in the business. They are not meant for sale. These assets increase the profit earning capacity of the business. Expenditure on these assets is not regular in nature. Ex. Land & building, Plant & Machinery, Vehicles, furniture etc.

- Circulating/Current assets: Current assets change their values constantly. For example cash in hand changes so many times during the day. There is always regular transaction regarding floating assets.

- Fictitious Assets: Fictitious assets are those assets, which do not have physical form. They don’t have any real value. These assets are the revenue expenditure of capital nature, which are also termed as deferred revenue expenditure.

- Tangible Assets: Tangible assets are available in physical form, which can be seen, touched. These assets are purchased and sold in open market.

- Intangible assets: These are the assets which are not normally purchased and sold in the open market such as goodwill and patents. It does not mean that these assets are never purchased and sold. They may be purchased and sold in special circumstances.

- Liability: Liabilities are the obligations or debts payable by the enterprise in future in the form of money or goods or services. It is the owner and creditor’s claim against the assets of the business. Creditors may classify as creditors for goods and creditors for expenses. The business should have sufficient current assets to meet its current liabilities and reasonable amount of fixed assets to meet its fixed liability.

- Non-Current or long term liabilities: The liabilities, which are to be paid after a long period of time exceeding one accounting year, are called long term liabilities. For example : Long Term loan from Bank.

- Current liabilities: The liabilities which are payable within a year are termed as current liabilities. Example: Sundry Creditors for supply of raw materials, Bills payables etc.

- Contingent liability: These are not the real liabilities. Future events can only decide whether it is really a liability or not. Due their uncertainty these liabilities are termed as contingent (doubtful) liabilities.

- Capital: The amount what is invested to start a business, to run or operate and expand the business is called capital. Capital can be classified as fixed capital and working capital.

- Fixed capital: The amount invested in acquiring fixed assets is called fixed capital. The money is blocked in fixed Assets and not available to meet the current liabilities.

- Working capital: The part of capital available with the firm for day-to-day working of the business is known as working capital.

- Purchases: Purchases include only the purchases of those goods, which are for the purpose of selling again. It does not include the purchase of assets.

- Returns outwards: It is that part of purchase of goods, which is returned to the seller. This return may be due to unnecessary, excessive, and defective supply of goods.

- Sales: Sales includes the sale of goods only in which the business organization deals in. The sale of old fixed assets will not be included in the sale.

- Return inward: It is that part of sales of goods which is actually returned to the organization by purchasers.

- Stock: The goods available with the business for sale on a particular date is termed as stock. In accounting we use the term stock widely as opening and closing stock. In case of business which is being carried on for the last so many years, the value of goods on the opening day of the accounting year is known as opening stock. In the same way the value of goods on the closing day of the accounting year is known as Closing stock.

- Revenue: Revenue in accounting means the amount realized or receivable from the sale of goods. Amount received from sale of assets or borrowing loan is not revenue. Revenue should not be confused with income. Revenue is concerned with receipts or receivables in day-to-day working of the business. Income is calculated by deducting expense from revenue.

- Expense: Generating revenue is the foremost objective of every business. The firm has to use certain goods and services to produce articles, sold by it. Payment for these goods and services is called ‘expense’. Cost of raw material for the manufacture of goods or the cost of goods purchased for sale, expenses incurred in manufacturing goods, such as wages, carriage, freight and amount spent for selling and distributing goods such as salaries, rent, advertising and insurance etc. Are known as ‘expense’ in accounting terminology.

- Debtors: The term ‘debtors’ represents the persons or parties who have purchased goods on credit from the business and have not paid for the goods sold to them. They still owe to the business.

- Creditors: In addition to cash purchases the firm has to make credit purchases also. The sellers of goods on credit to the firm are known as its creditors for goods. Creditors are the liability of the business. They will continue to remain the creditors of the firm so far the full payment is not made to them. Creditors may also be known as creditor for loan, creditors for expenses.

- Proprietors: An individual or group of persons who undertake the risk of the business are known as ‘proprietor’. They invest their funds into the business as capital.

- Drawings: Amount or goods withdrawn by the proprietor for his private or personal use is termed as drawing.

- Vouchers: Accounting transactions must be supported by documents. These documentary proofs in support of the transactions are termed as vouchers.

- Depreciation: Depreciation is the loss in the value and utility of assets due to constant use and expiry of times.

- Bad debts: The amount what is not recoverable from the debtors is considered as bad debt.

- Transactions: Transactions refers to those events or activities involving transfer of money or goods or services between two persons or two accounts. e.g. purchase of goods, sale of goods, borrowing from bank, lending of money, salaries paid, rent paid, commission received and dividend received. Transactions are of two types, namely, cash and credit transactions.

- Invoice: Invoice is a business document which is prepared when one sell goods to another. The statement is prepared by the seller of goods. It contains the information relating to name and address of the seller and the buyer, the date of sale and the clear description of goods with quantity and price.

18. Advantages of Accounting

1. Systematic and Complete record of Business: Now a days the transactions occurs in business are always in large number and very much complex in nature. Accounting records all these transactions of financial nature in a very systematic process.

2. Helps in ascertaining the operational result of the business: The systematic recording of transactions in accounting helps the business in knowing the result of the business i.e. Profit or loss in an accounting year.

3. Helps to ascertain the financial Position: Accounting provides information about the financial position through preparation of Balance sheet showing the Assets and Liabilities.

4. Legal Compliance: Accounting helps the business to comply with the legal requirements. For example: to comply with the requirements as per Income-tax Act, 1961.

5. Provides information to users: Accounting provides required information to various users as per their requirements to make decisions in relation to the business for an Govt. Authorities, Employees, Conditions, banks, owners etc. Whom it provides the information.

6. Helps in preventing and detecting fraud: The systematic recording of transactions helps the business in detecting and preventing frauds through internal check.

7. Helps to settle tax liability: Accountings helps in the assessment of Tax liability which is very much helpful in settlement of Tax liabilities of the business.

8. Helps management: Accountings helps management by providing required data and information of the business which are very much important in decision making. It also works as a basis for future planning about the business.

19. Limitations of Accounting

1. Does not consider qualitative information: Accounting records only the transactions of financial nature. It does not take into consideration any qualitative information though it, may be very important for the success of the business. For example, competency of employees, Govt. policy, competitions in the market etc.

2. Biasness: Accounting is not free from biasness. Accountants have to be biased in the treatment of some items in the business as regarding the treatment they have to apply their personnel judgment.

3. Ignores Price level changes: In the position statement (Balance Sheet) the assets are shown at historical cost though the actual value in the market might be different. Therefore, the balance sheet fails to show the real picture of the business.

4. Window dressing: Sometimes the management may try to show the inflated or deflated figures of Profit, assets, liabilities etc. Due to which the financial statement might fail to show the true and fair view of the business.

20. Relationships of accounting with other disciplines

The relationships of accounting with other disciplines are discussed below:

- Accounting and Management: In the modern day business context the management of a company has to take many decisions in relation to the business activities of the company. All the important decisions could be taken on the basis of the information available. The accounting helps the management in taking important decisions quickly and correctly by providing the necessary information.

- Accounting and Economics: There is a close relationship between accounting and economics. As both are related to the economic activities of business. Economics is concerned with how to satisfy demands of the human with the scarce resources available. Economics also studies the behaviour of people in relation to purchasing products and similarly the behaviour of firms in relation to sell. Accounting records the business transactions and provides information to both buyers and sellers in making important decisions.

- Accounting and Law: Every business has to comply with the laws which are related to the business in the country. Some important laws in India are, the Indian Companies Act, the Banking Regulation Act, the Partnership Act, the Indian Contract Act, the Factories Act, Payment of Wages Act, the Income-tax Act, Central and Provincial Sales Tax Act, the Wealth Tax Act, and Gift Tax Act etc. Accounting practice helps the business firm to comply with the regulations.

- Accounting and Statistics: Accounting and statistics also have some similarities. The objective of statistics is to collect various data related to some activities or events and present them to various users of that information as per requirements. Accounting also records the business transactions, summarise them and present them to various stakeholders as per their requirements.

No comments:

Post a Comment